160 Current Account Product Based on Wadiah Yad Dhamanah and Mudarabah Contract. With ijarah mawsufah fi zimmah also called forward ijarah a financier undertakes payment during the construction period whilst customers payments will start within a specific period after completion.

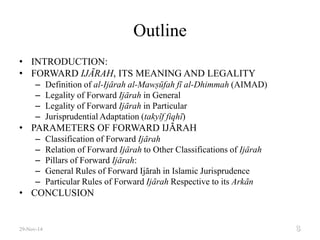

An Appraisal Of Al Ijarah Al Mawsufah Fi Al Dhimmah Forward Ijarah

Garis Panduan Sy ariah Dalam Aplikas i Ijarah Mawsufah Fi D himmah Pajakan H adapan Dan Isu - Isu Pelaburan Dalam Takaful.

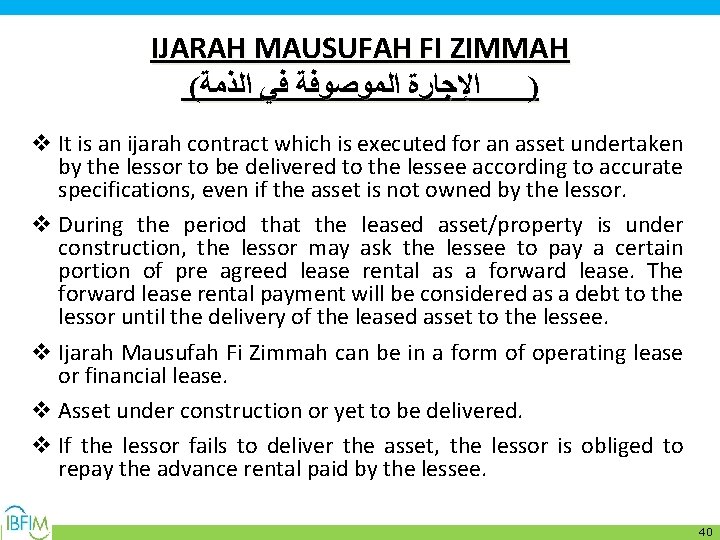

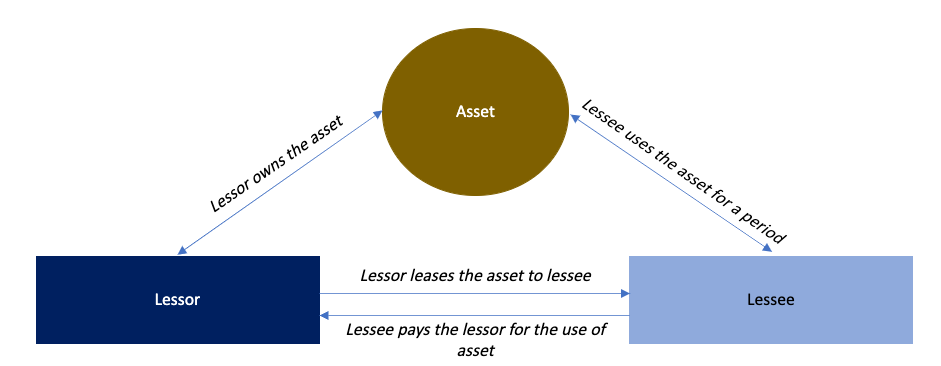

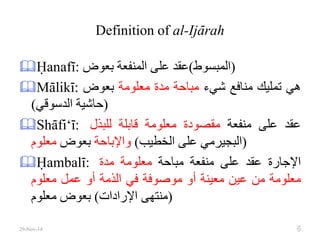

. Md Dahlan Nuarrual Hilal and Mohd Noor Fauziah and Shuib Mohd Sollehudin 2018 Ijarah Mausufah Fi Zimmah Islamic Home Finance In Dealing With Abandoned Housing Projects In Malaysia. The lessor however must refund the rent if he fails to deliver the object of the lease. School International Islamic University Malaysia IIUM Course Title ECON 3511.

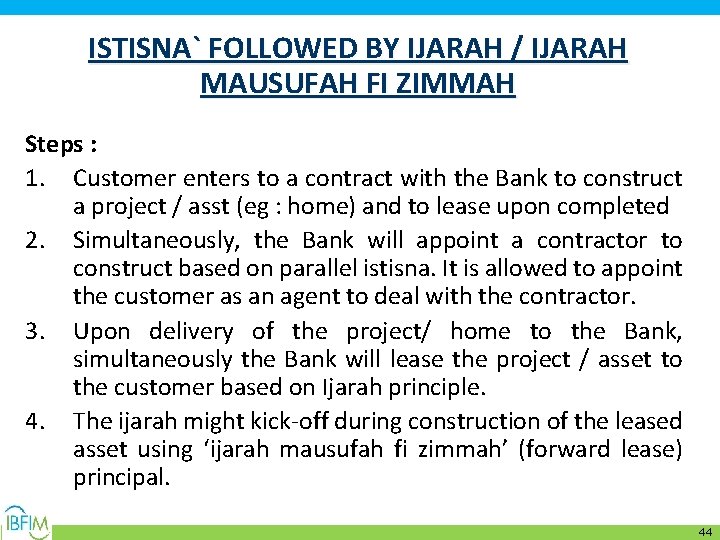

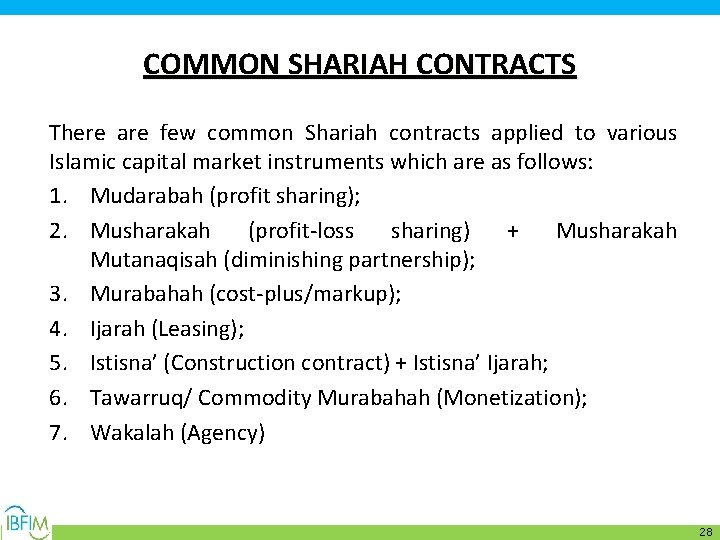

If there is a reasonable expectation that something will be made then we may structure a forward lease for which rent is collected today. Features Issues And Prospects. CONVERSION OF 1 HOME LEASING-i IJARAH TERM FINANCING-i FACILITY UNDER SHARIAH PRINCIPLE OF IJARAH MUNTAHIYA BITAMLIK AND 2 ISTISNA IJARAH HOME LEASING-i FACILITY UNDER THE PRINCIPLE OF IJARAH MAUSUFAH FI ZIMMAH CONVERSION 1.

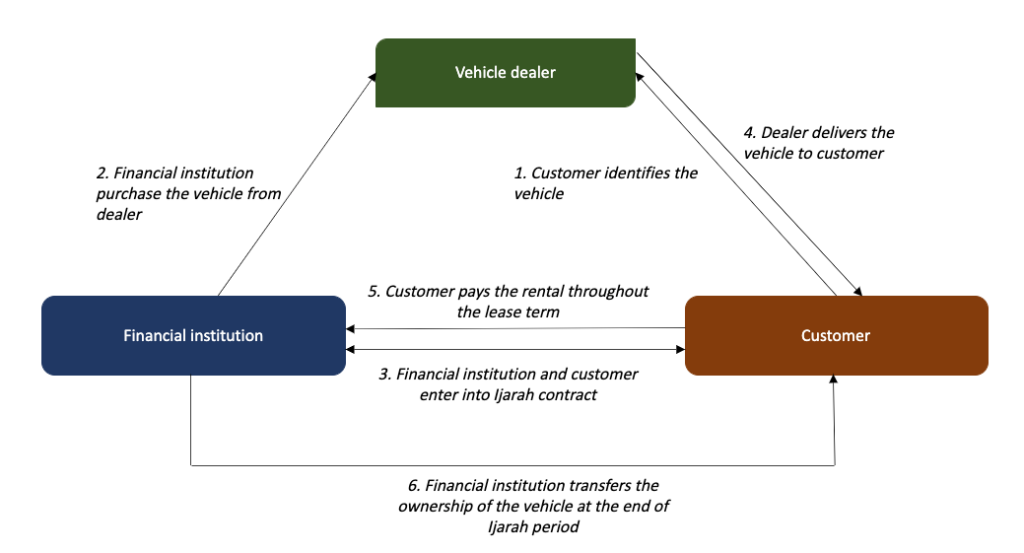

In this regard the customer agreed to commence paying monthly rent even though the house is still under construction. It may also refer to a lease contract in which the lessor undertakes to provide a well-defined service or benefit without identifying any specific assets to render it. KFH Ijarah Mawsufah Fi Al-Zimmah Asset Acquisition Financing-i The developers mortgage - a comprehensive Islamic home loan created especially for people buying properties under construction Product summary Tenure Up to 35 years Profit Rate from 345 pa.

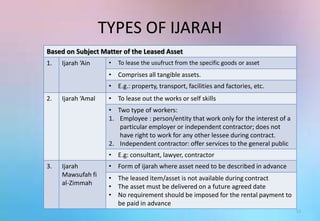

We will get back to you as soon as possible whether you need to report a problem have inquiry or suggestion. A type of ijarah which involves the sale of a clearly specified underlying asset which is currently being produced or constructed for a future delivery. The data analysis used is content analysis and critic analysis.

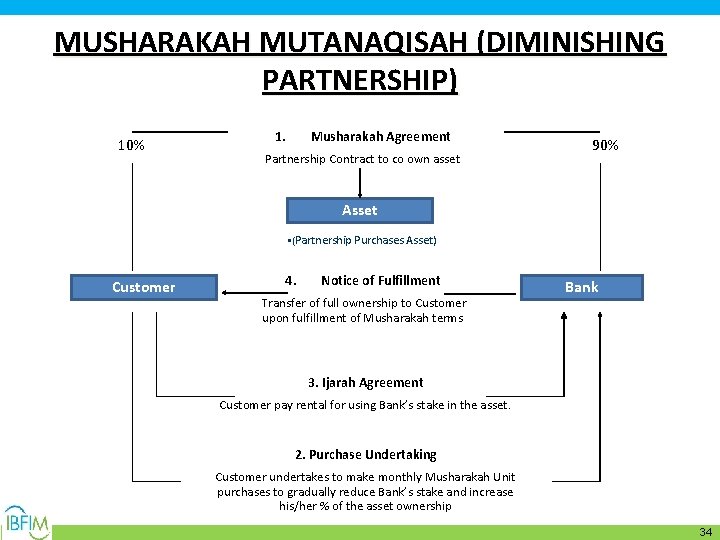

With ijarah mawsufa fi al-dhimmah also called forward ijarah a financier undertakes payment during the construction period whilst customers payments will start within a specific period. Ijarah mawsufah fi zimmah is a lease of an asset that is not yet available or owned by the lessor at the time of agreement. The agreement however is based on the undertaking by the lessor to deliver the asset based on agreed detailed specifications value and time of availability.

A CASE STUDY ON COMMODITY MURABAHAH PRODUCT AT MAYBANK ISLAMIC BERHAD NASRUN BIN MOHAMAD GHAZALI DEPARTMENT OF SHARIAH AND ECONOMICS. S 262 The forward lease agreement ijarah mawsufah fi al zimmah must be entered. 800 am - 800 pm.

Course Title BUSINESS I 206. Nuarrual Hilal Md Dahlan ACIS Fauziah Mohd Noor Mohd Sollehudin Shuib Font size A A A. According to the findings of this study al-Ijarah alMaushufah fi al-Dzimmah is a contract development employed to suit the communitys demands.

Ijarah with istisna g 211 the contracting parties. Ijarah Mawsufa Fi al-Dhimmah. With ijarah mawsufah fi zimmah also called forward ijarah a financier undertakes payment during the construction period whilst customers payments will start within a specific period.

The monotheism framework underpins the creation of al-Ijarah al-Maushufah fi al-Dzimmah in the study of Islamic financial economics. Ijarah Mausufah Fi Zhimmah An ijarah contract whose underlying is an unidentified unit of asset that will be leased at a future date. Features Up to 35 years or age 70 whichever is earlier for residential property and up to 15 years or age 60 whichever is earlier for commercial property.

Features Issues And Prospects. School Wawasan Open University Ipoh. Apart from qabd that other practical issues related to sukuk Ijarah Mawsufah Fi al Zimmah-are also discussed in this article.

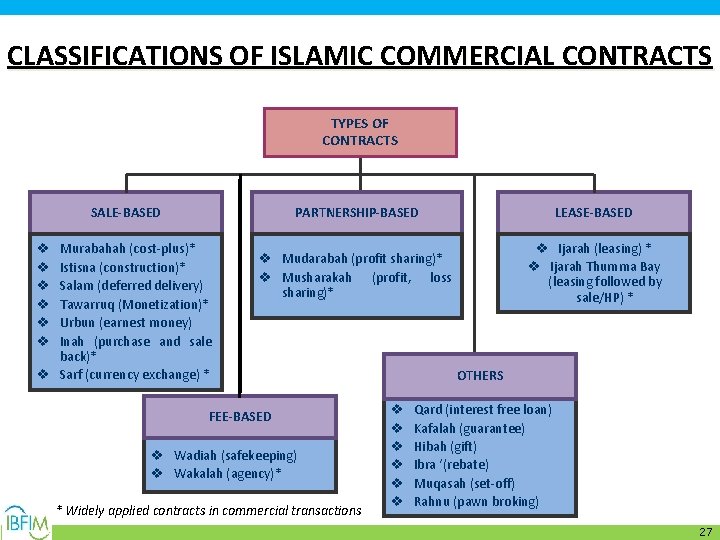

Loan type Term islamic financing Interest Type Floating profit rate Margin of finance up. Ijarah Mausufah Fi Zimmah Islamic Home Finance In Dealing With Abandoned Housing Projects In Malaysia. Although forward sales are impermissible under sharia forward contracting through ijarah is permissible provided that the rent amount will.

The rental paid is. Kindly be informed that MBSB Bank Berhad Company No. 716122-P MBSB Bank is undertaking.

Home Categories Islamic Finance Banking Leasing and its Types Practical Application of al-Ijarah al-Mawsufah fi al-Dhimmah Forward Ijarah 22 Oct 2009 Leasing and its Types. Ijarah with Istisna G 211 The contracting parties under ijarah mawsufah fi. 9th Universiti Utara Malaysia International Legal Conference 2017 ILC 2017 The European Proceedings of Social Behavioural Sciences 23.

KFH Ijarah Mausufah Fi Zimmah Asset Acquisition Financing-i is a forward lease contract for property under construction ending with ownership by way of gift sale. Application of Al-Ijarah Al-Maushufah Fi Al-Dzimmah for Infrastructure Project Financing in Indonesia articleFelix2019ApplicationOA titleApplication of Al-Ijarah Al-Maushufah Fi Al-Dzimmah for Infrastructure Project Financing in Indonesia authorRega Felix and Lastuti Abubakar journalYuridika year2019. 283 Tidak berlaku.

An Ijarah mawsufah fi al-dhimmah forward lease is a method of leasing where the lessor accepts rent prior to the delivery of an asset or property. Sukuk Ijarah Mawsufah Fi al Zimmah-relate to the issuance of sukuk for ownership of physical assets and usufruct sarfbay al asset backed - vs asset based mix of trading assets and possession of underlying assets. An Appraisal Of Al-Ijarah Al-Mawsufah Fi Al- Dhimmah Forward Ijarah From Fiqh Perspective By Akhtarzaite Aziz and Abu Talib Mohammad Monawer TAWARRUQ IN MALAYSIAN FINANCING SYSTEM.

The customer will also enter into ijarah mawsufah fi al-zimmah contract to lease the house which is still under construction. Forward Ijarah can be used as a standalone contract Monawer and. Pages 30 This preview shows page 22 -.

You can contact us by clicking the contact us button. 31 Ghuddah op cit m s 90 Al - Qasimi m s 5. S 262 the forward lease agreement ijarah mawsufah fi.

A type of ijarah which involves the sale of a clearly specified underlying asset which is currently being produced or constructed for a future delivery. Ijarah Mawsufah fi Dhimmah. Ijarah mawsufah fi al-dhimmah forward Ijarah is a lease contract under which a bank leases out a property under construction and the lessee is required to pay rent during the construction period and also upon completion of the home Bank Negara Malaysia 2009.

Modern Islamic Law Economics Islamic Charity Initiation Concepts

An Appraisal Of Al Ijarah Al Mawsufah Fi Al Dhimmah Forward Ijarah

![]()

What Is Ijarah Ijara In Islamic Banking Aims Uk

Modern Islamic Law Economics Islamic Charity Initiation Concepts

Ijarah Contract An Overview Of Islamic Lease Theaccsense

Ijarah Contract An Overview Of Islamic Lease Theaccsense

Shariah Resolutions In Islamic Finance Part 1 Shariah Contracts Pdf Free Download

Modern Islamic Law Economics Islamic Charity Initiation Concepts

An Appraisal Of Al Ijarah Al Mawsufah Fi Al Dhimmah Forward Ijarah

Modern Islamic Law Economics Islamic Charity Initiation Concepts

Shariah Resolutions In Islamic Finance Part 1 Shariah Contracts Pdf Free Download

Islamic Development Bank Is Db Use Of Islamic

An Appraisal Of Al Ijarah Al Mawsufah Fi Al Dhimmah Forward Ijarah

An Appraisal Of Al Ijarah Al Mawsufah Fi Al Dhimmah Forward Ijarah

Modern Islamic Law Economics Islamic Charity Initiation Concepts

Pdf On The Potential Growth Of Sukuk Issues And Its Challenges Semantic Scholar

An Appraisal Of Al Ijarah Al Mawsufah Fi Al Dhimmah Forward Ijarah